What is RNDIS, and how does it make my check scanner easier to set up?

A simple trick that lets you use your scanner with multiple operating systems, and no drivers to install By emulating an Ethernet connection over USB,

A simple trick that lets you use your scanner with multiple operating systems, and no drivers to install By emulating an Ethernet connection over USB,

Did you know? The ReceiptNOW printer has adjustable guides that let it accommodate rolls of thermal paper anywhere from 2.25” (57mm) to 3.25” (83mm) wide.

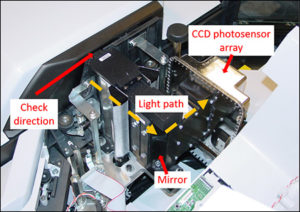

A scanner is equipped with three to four track sensors that detect the position of the paper as it moves through the track. The camera

Buildup on the feed rollers can be a source of unexplained jams and misfeeds. Dirty feed rollers, debris in the paper path, or obscured track

Dust or Ink on the Camera Glass If your scanned images look like the one below, it’s likely to make you think your scanner has

The main challenge with check processing is to streamline and automate the process to reduce keystrokes. Two technologies are used to automate this process. The

Experts Tell Us What They’re Really Seeing in the Field Note: This article is an excerpt from our case study, ‘An Alternative for Your Old

Among unusual events that took place in 2020, the resurgence of drive-up banking might not be the first that comes to mind. Nonetheless, one of

In a recent related article, we answered the question of why pneumatic tubes in drive-up banking lanes can interfere with the magnetic reading ability of

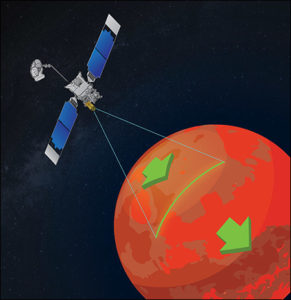

(And How Mars Global Surveyor Became the Biggest Scanner in the Solar System) This Sunday, May 30, 2021, marks exactly 50 years since the launch

If you’re experienced with cameras, you know that you need a minimum amount of distance between yourself and the object you’re trying to photograph. No

Today’s question comes from a customer in New York, who asks: “What should I do if someone gives me a check that’s torn at the