Any SEO expert will tell you that Google Trends can provide an interesting, if unscientific, look at what is going through people’s minds as high-profile events unfold. As Shawn Huber, an SEO manager for T-Mobile, once famously said: “No one lies to their search bars. It’s a treasure trove of data you’re not going to get anywhere else.”

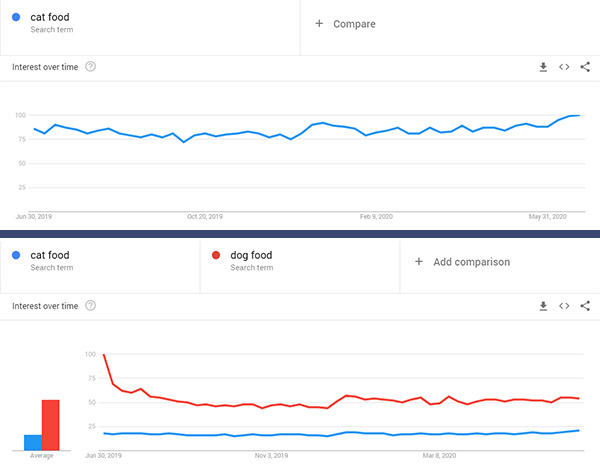

For the uninitiated, what Trends provides is a real-time picture of Google search volume for any given keyword, but with a huge catch – there are no numbers, it’s all relative. It won’t tell you how many people searched for a specific phrase on a specific day.

What you can tell is how much interest in a phrase has changed over time (relative to itself), or the comparative interest levels between two different terms. This can be incredibly useful if, for example, you’re interested in seeing whether a particular event caused a spike in interest for a particular product, or how the interest in a few different topics compared to each other.

In the banking industry, there has been no bigger news event in the past twelve months than the global virus outbreak, and the resulting government-imposed lockdowns. While banks and credit unions – classified as “essential businesses” – generally remained open in some form, their physical branches were subject to many of the same restrictions as everyone else.

We spoke with several banks who had made big pushes during the epidemic to migrate their customers from retail branches to digital channels: Online banking, mobile apps, and in the case of checks, remote deposit capture.

But what were the customers looking for? Did the banks get it right – and if not, what lessons can we take away?

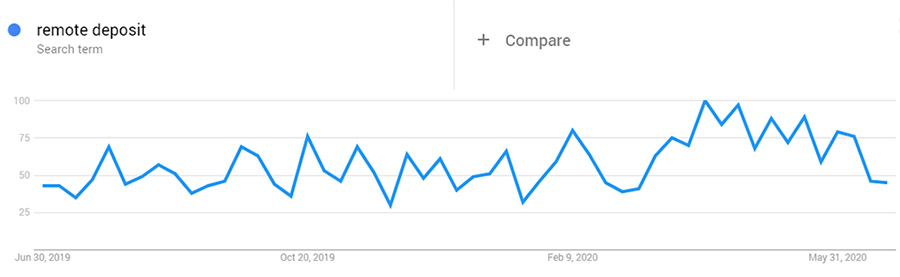

Since we’re in the check business, let’s take a look at a couple of keywords related to that first. Remote deposit – the act of scanning a check and depositing it online – should have seen a huge jump in interest starting in mid-March, when the concern over the virus rose to its height, and the first restrictions on retail branches began to take effect. Did it?

Based on search volumes, it certainly seems like it was on people’s radar. While searches for “remote deposit” didn’t shoot through the roof, they reached their highest level for the year, and maintained an elevated level for several weeks before returning close to normal recently. How did that compare with some other phrases used to describe depositing checks?

Wow! Now that’s what a big surge in interest looks like. Not only is the overall volume much higher for terms like “mobile deposit” and “online deposit,” the peak is much more pronounced. Why the difference? Likely because “remote deposit” is more of a business term, originally used to mean online check deposit using a desktop scanner attached to your PC. Mobile deposit, being a more consumer-oriented service, attracts more eyeballs, likely including a lot of individuals who had never used it before but had their hands forced. One can only assume a similar explanation for online deposit as well.

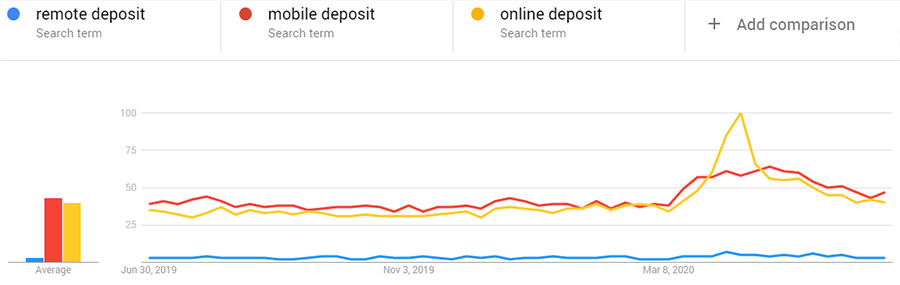

What about some more mainstream words about other banking services – how did they fare?

If you want to see a real difference, it seems like the place to start is with basic information. The interest graphs seem to show an immediate five-fold or ten-fold increase in searches for simple requests like whether the local branch is still open, with a much bigger spike in searches for online services following in the weeks just after.

How to read this strange phenomenon? Were people hoping for business as usual at first, then reluctantly searching for alternatives two to three weeks later? If so, this early window could be a key time to get the right services out in front of people if a similar prolonged emergency arrives in the future.

As expected, once the COVID-19 restrictions were in full swing, searches for alternatives to the branch swiftly overtook those for in-person services, and online outpaced physical. However, those who would use this to predict the doom of the brick-and-mortar branch might want to take another look at the top graph above. Interest in services that could replace a branch visit shot up and then right back down again within three to four weeks (presumably, after people had figured out their solutions). On the other hand, people got interested in whether physical branches were open, and stayed interested.

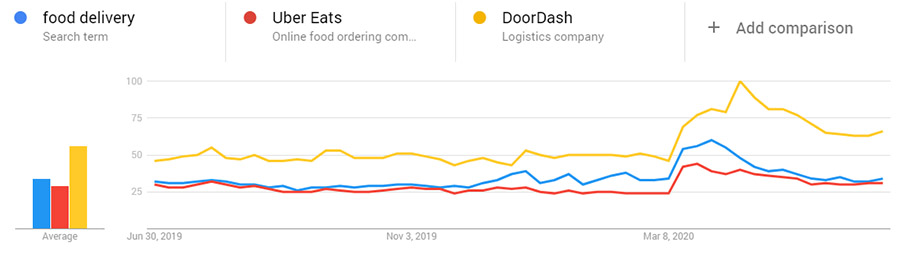

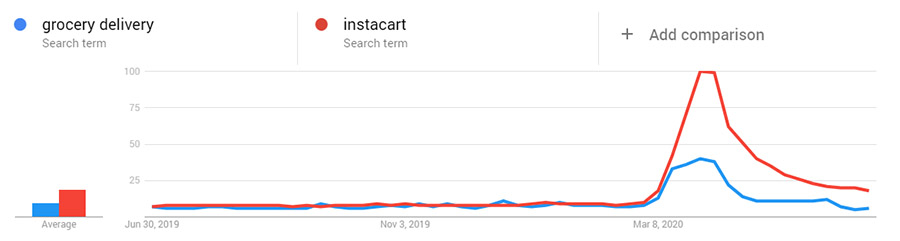

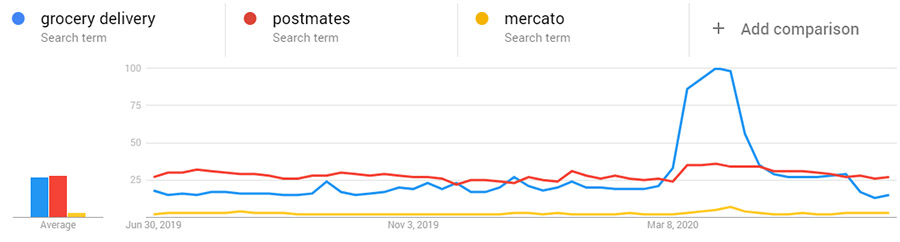

Outside of banking, did any particular brands or companies benefit from a spike in search traffic during this time? Well, of course they did – as everyone knows, online commerce of all kinds went gangbusters.

So, how much of that was tied to brand recognition, and how much simply coincided with general interest in the same type of service? Certainly, exhaustive studies will be written about this, but in the meantime, a first, very unscientific glance shows brand names and general category searches seeming to move in lockstep:

But what happens when you move to the second- and third-place brands in a category, and below? There, the picture is a lot less rosy:

The message: It pays to be at the top (obviously). If you’re not the category king, you’re relying on the side effects of the general-interest search – but when you’re #1, you get that plus a big bump in direct searches.

How that applies to banking and finance is a bit murkier picture – there were few clear standouts there that were not product- or information-related searches. Then again, banks weren’t in one of the “fortunate” categories of novel services that people flocked to out of necessity. They were more of an existing entity that was struggling to find a way to keep providing service, much like most other traditional companies. So perhaps the message is that being well-positioned with a good array of useful products and services in advance is the key to taking advantage of the general search traffic when it comes.

Of course, few things saw a more rocket-like rise and fall in interest than one product in particular, and you can probably guess which one that was. Another company gave that popularity a run for its money shortly afterward, though, and was certainly more “rocket-like” in the true sense. And so we will conclude with one last search trend comparison, illustrating perhaps the ultimate contrast between high-tech and low-tech in all of history. These are strange times indeed.