Image Quality Analysis, or IQA, in banking refers to the process of evaluating a scanned check image for readability. This generally involves using an automated process to be sure the key information such as the MICR account and routing number, date, and dollar value are all clearly visible in the final black-and-white bitonal image that is sent out for clearing. It is important that this image meet minimum standards of legibility, since in electronic clearing, the bank on the receiving end will not have access to the original paper document in case of any discrepancies.

IQA is typically done in two places: First, by the bank that scanned the check, prior to sending the image out; and again once the image is received at the end of the clearing process. If an image fails IQA, one of two things may happen, depending on where the error occurred. If it fails at the original bank during the scanning process, it is called an exception item, typically meaning that the bank will re-scan the item or do a manual inspection before sending it on. If it fails on the receiving end of the clearing process, it is designated a non-conforming image, or NCI, meaning that it is rejected by the receiving bank and sent back for clarification. The NCI process may involve extra delays, as well as fees to the bank that scanned the check, so it is far preferable for banks to catch problems as exception items during their own IQA process.

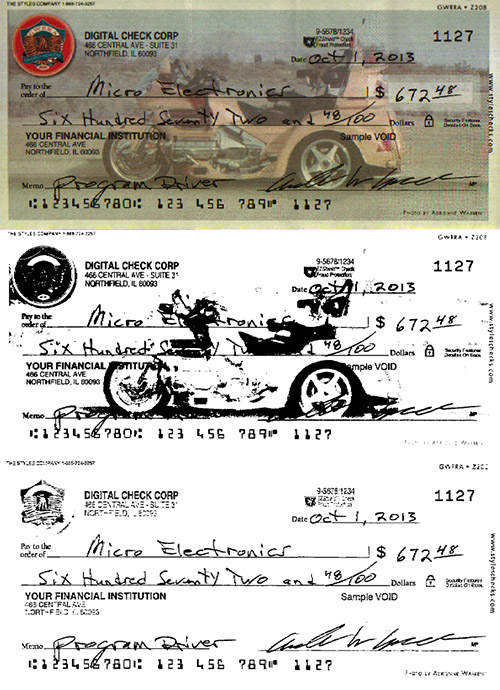

Common reasons why a check may fail image quality analysis include poor handwriting; colored ink, especially from gel pens; interference from background printing; machine printing in reverse type; or key information printed outside its normal location on the check. It is important to note that IQA refers only to the readability of the captured image, not the original paper document. In many cases, such as in the example at right, even though the original full-color version of the check may be legible to the human eye, the black-and-white image of the check may not be. In these cases, a manual inspection of the original to confirm the key information is not sufficient — as the image will still fail IQA at the receiving bank if sent without being cleaned up or re-scanned.