A Non-Conforming Image, or NCI in banking occurs when a scanned image of a check is transmitted for clearing, but is rejected during clearing, and then sent back (without being processed) to the bank that scanned the check. This may happen for a few different reasons, as explained below.

It is important to note that a non-conforming image rejection is NOT the same thing as an insufficient funds (NSF) rejection, also commonly called a returned check or bounced check. That type of rejection occurs when a check goes all the way through the clearing process, and the payor’s account does not have enough money to cover the amount of the check. A non-conforming image reject occurs because there is some problem with the check image that prevents it from being processed in the first place.

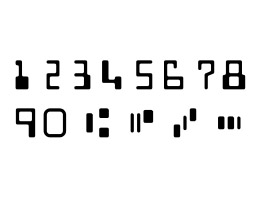

One of the most common reasons for an non-conforming image reject is poor image quality, which renders part of the check illegible to the recipient. This type of NCI often occurs when a check does not produce a good machine-readable image, but the human operator corrects the error by looking at the original paper document and manually keying in the obscured information, such as the legal amount or the courtesy dollar amount. While the correct information may be visible on the paper itself, only the scanned image will be available on the receiving end, and so the check may be rejected.

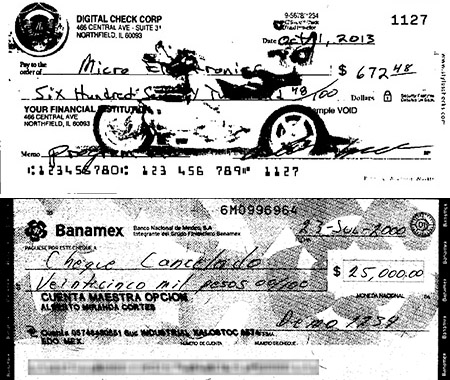

Other reasons for NCI rejections include an invalid routing number (no bank exists that matches the information on the bottom of the check; therefore it cannot be cleared), or items such as foreign checks that are not eligible to be cleared as images.

Depending on the reason for the error, non-conforming images can be very expensive and time-consuming for a bank to resolve — for example, if someone has to go back and find the original paper item, or if an especially difficult document is incapable of producing a legible image and needs to be physically delivered for paper clearing. For this reason, image quality has become a top priority for banks and scanner manufacturers alike.