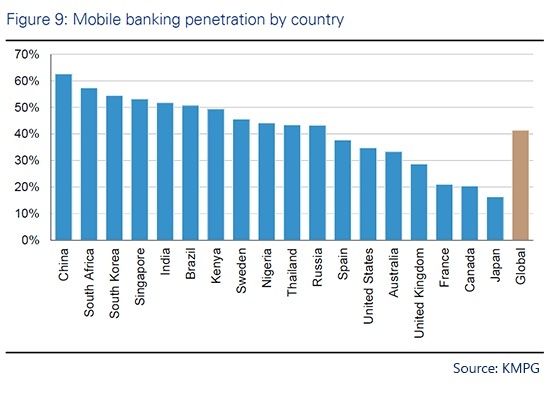

Quick – can you name the ten countries with the highest percentage of the population using mobile banking?

You probably guessed some combination of Japan, a few Western European countries, and a handful of other countries with “modern” banking systems, like Canada, Australia, South Korea, or maybe even the U.S. But you might be surprised to know that the real top 10 list includes places like China, South Africa, India, Brazil, Kenya, and Nigeria – and that many Western nations lag far behind the developing world in mobile adoption rates. That’s the latest according to a new report on mobile banking trends by KPMG and UBS Evidence Lab.

So, why is mobile taking off so much more quickly in places far from home? Our country manager for India, Ninad Chavan, filled us in on a few reasons why it’s become so popular in his country.

The better the branch experience, the less the incentive to switch to online or mobile.

Visiting a bank branch in India can be far from pleasant, says Chavan. Crowds are big, lines are long, and wait times extensive. But before you chalk this up to a weak infrastructure, you should know that India actually had more bank branches than the United States as of 2013 – over 102,000 compared to about 95,000 in the U.S. What’s more, that number has increased by a quarter since 2009, while the number of branches in the U.S. continues to shrink.

Perhaps a better indicator of the expected banking experience is the number of branches per capita, where India falls well behind because its population is quadruple that of the United States. In fact, according to the World Bank, the U.S., with 33.9 branches per 10,000 adults, has more branches per capita than every one of the top 10 mobile-using countries except Brazil. Most of the countries on that list tend to average 10-12 branches per 10,000 population, with some – like Nigeria and Kenya – falling into the mid-single digits. In contrast, some of the “high-tech” countries bringing up the rear of mobile adoption have branch counts in the 20s and 30s: Australia (30.7), France (38.7), Canada (24.4), the UK (22.2), and Japan (33.9, same as the U.S.).

In other words, people are too lazy to switch. Unless going to the branch is unpleasant, they’ll just keep going to the branch, no matter where in the world they are. Exactly where this threshold of tolerance is located remains a mystery, but based on the per-capita figures, it’s clear that the U.S. has a long way to go before the branch experience forces them to switch their behavior. It’s no surprise that, in the same KPMG study, the top reason given for not using mobile – at 86% of respondents – was “Banking needs are met without mobile.”

Another factor is location: Many rural areas of India, for example, lack bank branches and ATMs, and until fairly recently relied on bank representatives who would make weekly or monthly visits to conduct business. (Despite its high number of branches per person, many remote areas of Brazil suffer from the same types of problems.) So on a regional level, lack of physical availability can drive people to mobile just as surely.

The type of Internet access available makes a big difference.

In India, it’s common to find Internet service available for 500 rupees (about $7.50) per month, which typically includes a basic connection and a data cap of a few hundred megabytes. The most popular plans tend to be in the $20 range. So Internet service is cheap.

|

|

But computers are not cheap, and so a growing trend among Indians in their 20s and 30s is to pay for inexpensive Internet plans and use their phones as the main method of going online. In many areas of Africa, access to wired Internet is sporadic or unavailable, and so the mobile phone has also become the main access point. As in many countries in the developing world, a core segment of the population there has skipped online PC access and gone straight to mobile.

Banks are promoting mobile harder.

Banks in India are eager to encourage mobile, says Chavan – and importantly, they’re promoting it as a primary means of doing business, not an accessory service. They’re not levying charges; apps are developed quickly and given high priority; and the mobile experience is treated as part of the core experience of today, not the future. While the cost of opening enough bank branches to measurably improve the customer experience may be prohibitive, mobile’s low cost and scalability have provided some much-needed relief from the long lines and crowds.

So, does this mean mobile is not going to take off in the West? Not necessarily. KPMG’s study points out that the age gap between mobile and non-mobile banking users in the U.S. stands at 15.3 years; Australia, Canada, the U.K., and Sweden round out the top five on that list. At the bottom are Nigeria, Thailand, and Kenya, with age differences of 1 year and less, which is essentially no difference at all. That shows that there’s likely to be some significant generational cycling in Western countries as members of the younger age groups become customers. But without as many compelling forces pushing us toward mobile en masse, the full migration for Americans is likely to take a decade or so longer.