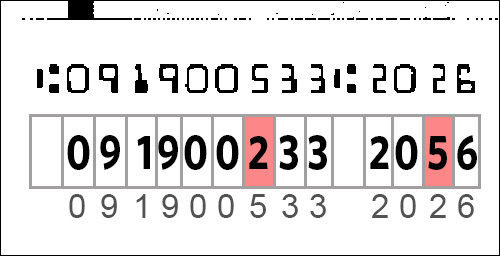

A MICR / OCR mismatch occurs when the magnetic reading from the bottom line of a check or money order does not match the numbers captured in visible light. Most modern teller capture or remote deposit systems “double check” account numbers and routing numbers by taking two separate readings of the characters printed at the bottom of these documents.

The first reading uses magnetic ink character recognition, or MICR, to pick up the magnetic signature of the printed characters. The second reading is an ordinary scan to an image file, which is analyzed using Optical Character Recognition, or OCR. The two readings are then compared with each other, and if any numbers don’t match, the check is flagged with an error message for manual inspection.

MICR reading is highly accurate — over 99.9% under normal conditions — but most problems typically occur if a check was printed with weak magnetic ink (such as the toner used in laser printers), or with no magnetic ink at all. In those cases, the OCR backup reading will identify incorrect or dropped digits and trigger a warning. Since they use completely different methods of reading the characters, the odds of MICR and OCR both returning the same incorrect digit are virtually zero.

One of the limitations of mobile deposit is that smartphones have no way of capturing MICR data, so reading the bottom line relies solely on OCR of the image captured by the phone’s camera. Since those numbers are critically important, banks and credit unions tend to have very strict quality requirements for mobile deposit images.