[note — If you missed the main part of this case study, CMP: Using Reader/Sorters to Process a Million Mexican Payment Documents a Day, you’re not getting the whole story! Please follow the link above to see the full context of how reader/sorters are used.]

If you’ve never worked for a company in Mexico, chances are you don’t know about the voucher system that many companies use to supplement their payrolls. Put simply, most employees are given food and gas coupons along with their paychecks, and these can be redeemed at thousands of grocery stores, retailers, and restaurants around the country.

The reason for this is because food coupons are non-taxable in Mexico, and they also don’t count as part of an employee’s gross salary. That’s made them an extra benefit to both the employee and the company, so they’ve become commonplace as a result. (For any Americans reading this, think of it like the same thing as a tax-exempt transit ticket program, or an employer-funded version of a medical Flexible Spending Account – only for gas and groceries instead.)

The complicated part of this system comes when it’s time to turn the coupons in. While some companies provide them in electronic form – similar to a reloadable debit card that can be used for food and gas – not all employers are equipped to do this; not all retailers are set up to accept the cards; and not all employees want them. The net result is that hundreds of millions of food coupons are handed out in old-fashioned paper form every month.

After someone uses a coupon to buy food or gas, the retailer then must submit it back to the issuer in order to actually get paid. The “issuer” is usually a third party company (not the customer’s employer) that manages benefit coupon programs on behalf of many other businesses. Two companies, Sodexo and Edenred, issue a large percentage of Mexico’s food benefit coupons, but many smaller firms also occupy a sizeable market share.

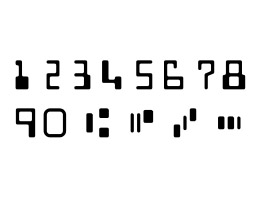

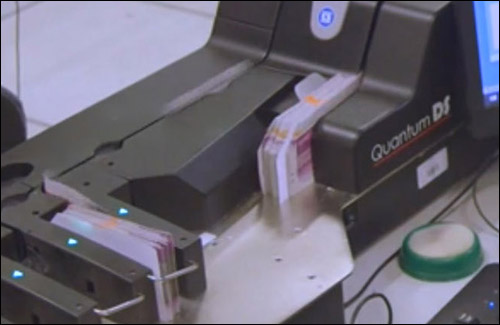

Fortunately, each coupon issuer has its own identifying number, which is printed on the bottom of the coupon in magnetic ink, much like the MICR routing number on a check. That means a regular check scanner can read coupons and determine their origin. If the magnetic numbering cannot be read, a machine-readable barcode is also printed on the coupon containing the same information. The value of each coupon is also encoded in both the MICR and the barcode, making settlement easy and automated.For final settlement, the coupons go through a clearing process similar to that used with checks – although instead of between two banks, it’s between the retailers and the issuers. Images of the coupons are not used for this purpose, only the magnetic information and the value. In this respect, the process is closer to the simple check truncation process that existed before image-based clearing came into use.

The result of Mexico’s tax-exempt coupons is almost like a separate payments rail that works in parallel with checks, and with similar processing methods, but without the two systems overlapping each other. For companies like CMP, that means speed and accuracy – in both MICR and OCR – are at a premium.