2002

Maintaining Contract Manufacturing Ventures

In the 1980s and 1990s, our company underwent a transformation as it went from manufacturing products related primarily to high-end microfilm cameras, and moved more toward digital imaging. During that time, we became established as a contract manufacturer of electronics for companies like Honeywell, Bell & Howell, Motorola, and others.

Although the full significance wouldn’t become clear until much later, a pivotal moment occurred around the turn of the millennium, when we began contract manufacturing and direct importing of a new product, the check scanner. Glenn Embury, our respected engineer who has since retired, played a vital role in the comprehensive oversight of our manufacturing processes.

“We assembled the TellerScan TS400 and 400ES products from kits. Additionally, we sourced the TS300 and 350 EBS units from our partner HTL in Italy, along with the Buic scanner from Buic. We were also responsible for contract manufacturing for ST Imaging, producing the Gideon reader filler, carriers, etc. Simultaneously, we handled the ImagR and micro trac products for Kodak. In essence, we functioned as a contract manufacturer for Digital Check, ST Imaging, and Kodak during that period.”

‐ Glenn Embury

MILESTONES

Growth in CA Manufacturing:

Before 2004, our monthly scanner production was below 100 units, assembled from kits supplied by our partner in Italy, HTL. During this period, our main focus was on serving as a contract manufacturer for Kodak and ST Imaging.

Capacity:

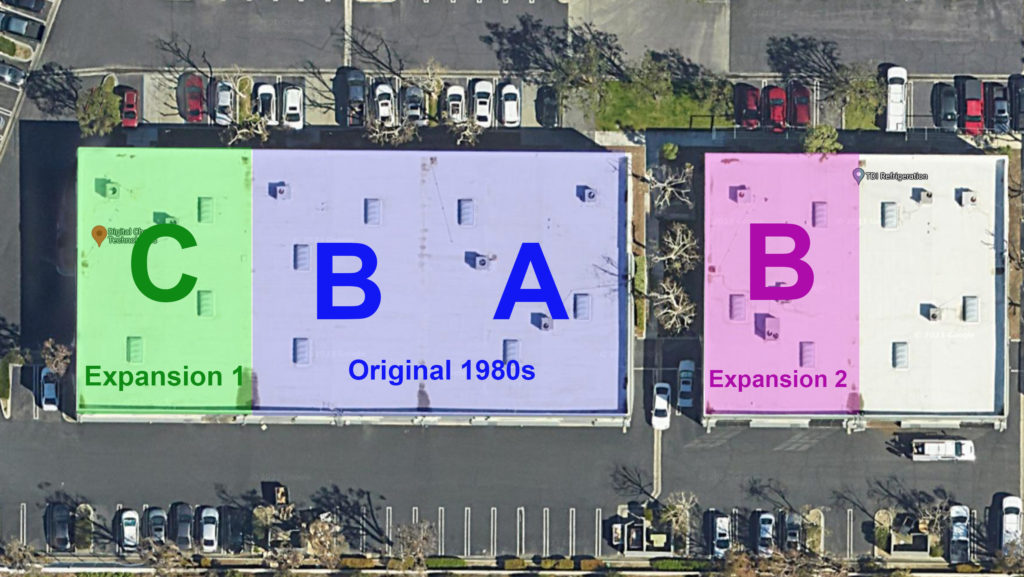

In 2002, we operated within an 11,000 square-foot facility encompassing manufacturing, engineering, accounting, IT, service, and other departments. It was estimated we could produce around 25,000 scanners per year if needed — but before the Check 21 Act, demand never came close to that.

Supply Chain:

In 2002, all procurement was domestic, except for the scanner parts kit received from our partner in Italy.

Employees:

In 2002, our California plant had roughly 15 employees.

Process:

In 2002, due to the limited volume, the assembly process was somewhat ad-hoc, and testing procedures were subjective.