Check exception items are checks that, for any of a number of reasons, cannot be mechanically processed by a bank or financial institution. These items may include checks drawn on foreign banks, checks with no signature and sometimes no rear endorsement, stop-payment items, items drawn on closed accounts, items with poor image quality, or for other reasons that don’t meet criteria set by the bank.

Exceptions items slow or sometimes stop the workflow process and that costs both time and money for the bank or financial institution. There are many documents that are known to cause exception item processing – either rescanning or manual keying of the items. These items include money orders, traveler’s checks, savings bonds, corporate payroll checks with weak MICR, and others.

Depending upon the operational setup, these items are either set aside for later processing or sent to a back office for reprocessing. In either case, it delays the deposit and requires additional personnel or time to process these items. That means added cost and an impact to the overall customer experience.

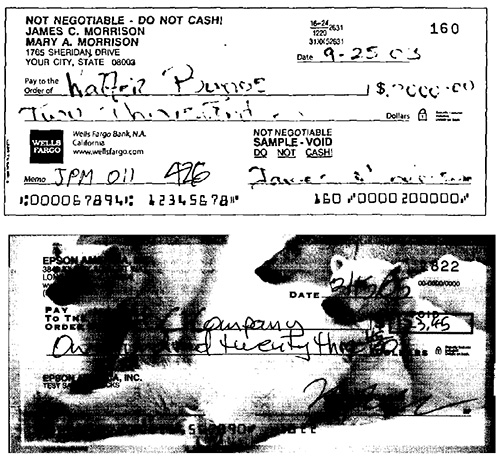

One example of technology we use to address exception items at Digital Check is the Special Document Handling, or SDH, features that’s built into our API. If the same type of check or money order is causing repeated exceptions, SDH identifies these items via their routing/transit number (and sometimes by the account number) to apply special image thresholding settings to the document. That produces a higher-quality image that will pass image quality analysis (IQA) tests. Thresholding is the process of removing the background image from the item, while retaining the important information such as the courtesy and legal amounts, to whom the item is written, and the signature.