|

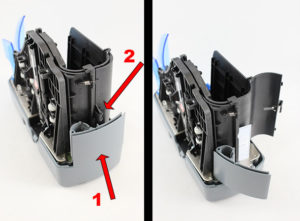

In an earlier edition of Digital Communications, we discussed the subject of NCIs conforming images) and the impact that they can have on the ROI of your bank’s teller check capture project. In that issue we discussed the fact that the cost of researching and repairing a check that is returned by the Fed can range from $9-$27 per item, while the cost of items on which the MICR can’t be read is estimated at $0.25 per item and misreads cost between $0.05-$0.10 per item. These are costs that are often not factored in when calculating ROI for a teller image project. These costs can be as high as $5,000 or more based upon substation errors and NCIs. The cost of teller image capture is not just in the cost of software and hardware. Digital Check has developed technology within our API to help minimize the number of MICR misreads and can’t reads, as well as the number of NCIs and unreadable images. One best practice that Digital Check recommends is to go to your bank’s processing centers to examine and test the difficult-to-read documents, especially those items that regularly end up in the transport’s reject pocket. The types of payment documents coming through a branch or region can vary widely based upon the businesses in the area, such as items unique to a geographic region (including state WIC and other types of reimbursement checks, money orders unique to that region, savings bonds, and other regionally unique items). Investigating these items, especially those items that hit the reject pocket of your reader/sorters, to look for difficult-to-read items that come through on a regular basis will allow you to create special thresholding settings and CAR/LAR templates before your teller roll out in order to reduce the number of NCIs. For these types of documents, Digital Check has developed a solution called Special Documents Handling, a unique feature that allows us to quickly calibrate our thresholding settings uniquely to that item and lock in the settings. This feature even allows us to focus in on a particular zone on the document to give special thresholding settings to that specific part of the document. This feature allows us to create multiple zones for documents like Money Gram or US Postal money orders which contain both light and dark areas that require disparate thresholding settings. These settings are gathered and stored in a special file that each customer of Digital Check bank check scanners has access to and can benefit from in their projects. Digital Check is willing to work with your organization to develop and participate in best-practices development and project management to ensure the highest level of success for your teller or branch roll out. For more information about Digital Check scanners and the training we offer, please contact us at 847-446-2285, or fill out our web contact form. |

The cost to fix problem documents can range from $0.05 for simple misreads, to as much as $27 for items returned by the Federal Reserve Bank.Find out how your Digital Check scanner can be programmed to automatically compensate for hard-to-read documents with our revolutionary Special Document Handling technology.

In this section: Inside MICR scanning Case Study: Extraco Banks – Teller Capture Check out Digital Check’s Other Teller & Branch Products:TellerScan TS500 |