On October 28, we announced the release of our most ambitious new software product yet, Clear by Digital CheckTM. Clear takes care of the “worst of the worst” poor-quality check images that currently fail in the electronic clearing process, costing banks millions of dollars annually nationwide.

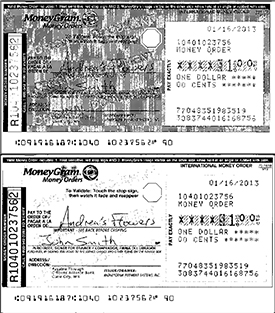

A money order scans poorly because of the varying background intensity ”” an intentional security feature. At bottom, the same money order after filters are applied to “clean up” the background interference. |

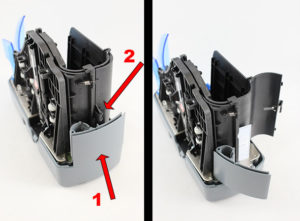

What problem does Clear solve? Simply put, Clear provides a more efficient way for banks to handle those image exceptions that are rejected during the clearing process as a result of a quality defect. That means removing background interference, compensating for heavy or faint printing, and optimizing contrast and brightness in key areas to improve readability. Then, if there are still problems that need to be addressed, a human operator can use a patent-pending click-and-drag interface to select individual areas and further enhance them.

In its initial runs, Clear has proven particularly useful in dealing with money orders, whose security printing often makes it almost impossible to capture a reliable image when scanned. A common tactic used in document security is to use a security background of variable dark and light printing (see example at right) to “confuse” any machine trying to capture and reproduce an image of that document. If the device tries to optimize light levels for the darker side of the document, the light portion comes out too faint to read. If it tries to optimize for the lighter side of the document, the dark portion is so dark that it’s illegible. The same issue can occur if a check contains especially heavy printing in an area, even if it was not intended as a security feature.

Clear breaks free from this problem by decoupling the light levels and contrast from the full image; for example, it is perfectly reasonable to scan an item using one setting for the left side and another for the right. This can be used to remove most background interference, and can be fully automated for document types that come up frequently. The click-and-drag option can then be used for custom adjustments to individual documents.

Banks that are using Clear report the biggest gains from removing costly Day 2 processes, particularly any transit costs or paper clearing fees for checks that previously just could not be made into quality images. Because Clear can be used on images scanned anywhere ”” at an operations center, at a branch, or even on those sent in via remote deposit ”” problem items don’t have to be sent to a central location for a second attempt at processing. And because Clear can work from archived images, it may not even be necessary to pull the original paper item at all!

Clear is a banking program, not just an image editor, so it is designed to integrate with the key workflow areas that bankers need to process checks. It allows MICR and amount corrections, and exports finished images into an X9.37 file for clearing. You will not find another imaging system like Clear on the market.

Clear is available now, and can be configured for financial institutions of all sizes, and with virtually any type of clearing operations structure. To learn more, visit the Clear product page or contact us today.