Since the Canadian banking system’s much-anticipated new clearing system went live in late 2014, two questions we’ve been getting a lot are: “Will I be able to scan Canadian checks (or cheques, as the case may be) from the U.S. side of the border?” and “Will this lower the fees and wait times when I take a Canadian check to my bank?”

For those of you unfamiliar with the process, depositing a check from Canada – or most other foreign countries – can be an expensive and time-consuming task. In fact, it’s obscure enough that even the banks are fooled sometimes:

The customer typically must bring the original paper check to his or her bank, which charges a fee of up to several dollars, plus foreign-exchange fees, if applicable, followed by a waiting period of days or even weeks before the funds are finally released.

Why all the extra hassle? Well, to be fair, it’s a lot of trouble for the banks, too. Since the two countries’ check-clearing systems have never been connected, the only way for an American bank to actually get the money from a check drawn on a Canadian financial institution has always been to physically return the check to Canada for processing. Often times, they will send all their Canadian checks to one bank – most likely one of the major ones like Bank of Montreal, TD Bank or RBC that has operations on both sides of the border – and that bank will route it on to its final destination, where (eventually) the funds will be released and the American bank notified. Sending the check to the Canadian “gateway” bank takes time and money, and of course, it costs the gateway bank money to finally clear the check as well. So in the end, it’s a lot of work and a lot of waiting for everyone.

One day, it may not be like this. Right now, we have scanners deployed all over the world in places like Egypt, Australia and France for the sole purpose of scanning American checks and transmitting them back to the U.S. electronically. These are typically in places like hotels, embassies and tourist attractions that draw a lot of American tourists or expats, and most of these outfits keep an account at a U.S. bank. But the point is, if it’s an American check and you’re doing business with an American bank, you can transmit the check from anywhere in the world.

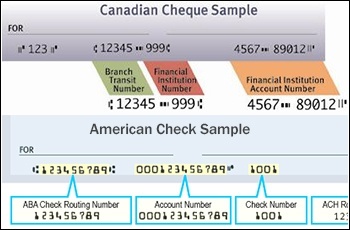

So, now that Canada has image-based clearing, shouldn’t we be able to just scan and send an image – whether it’s the customer or the bank doing the sending? The answer is not yet. While American and Canadian checks are very similar, one problem for machines is the different MICR numbering systems used in the magnetic ink at the bottom. If an American remote deposit or bank back-office system sees a check in the Canadian format, it will spit it out as an error.

So, now that Canada has image-based clearing, shouldn’t we be able to just scan and send an image – whether it’s the customer or the bank doing the sending? The answer is not yet. While American and Canadian checks are very similar, one problem for machines is the different MICR numbering systems used in the magnetic ink at the bottom. If an American remote deposit or bank back-office system sees a check in the Canadian format, it will spit it out as an error.

Would it be possible to fix this? Yes, but it would take time. While it may seem simple enough to program a second set of MICR code rules into an American scanning system, there is also the matter of segregating the foreign checks from the U.S. checks, and preparing them in a different file format for a separate transmission to a different place. So it’s a bit more complicated, and likely a matter of when the banking-systems makers have time to write an update somewhere between moderate and major into their software, or until banks find a different workaround. For the time being, the answer is still “coming soon.”